|

Name:

Cash App

|

|

|

Version:

V2.47.2

|

Price:

Free

|

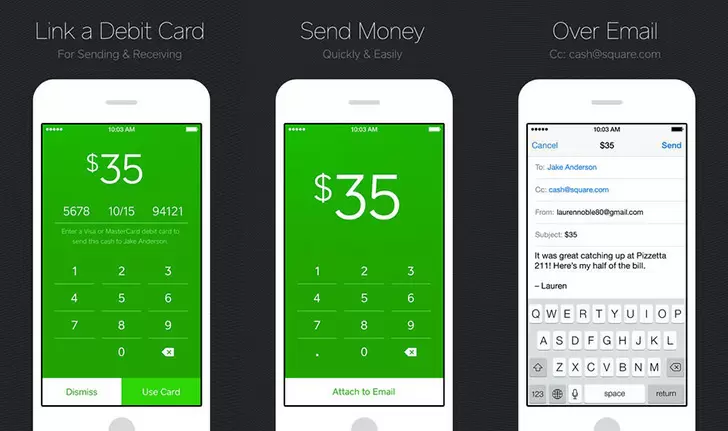

Cash App is a popular mobile payment service and financial platform developed by Square, the financial services and digital payments company founded by Jack Dorsey. Since its launch in 2013 as Square Cash, the app has grown significantly and now boasts over 70 million annual active users as of 2023.

Cash App enables users to easily send and receive money, invest in stocks and bitcoin, receive direct deposits, and spend money using a free customizable debit card called the Cash Card. The app is available for iOS and Android devices and is primarily aimed at younger demographics, instant payment use cases, and those seeking an easy introduction to investing.

In this comprehensive guide, we’ll explore the key features and uses of Cash App, its pros and cons, how it works under the hood, its security and privacy policies, how it makes money, and alternatives to consider.

Key Features and Uses

Peer-to-Peer Payments

The primary function of Cash App is to allow users to quickly and seamlessly send money back and forth to friends, family, and others. Users link their bank account or debit card and can instantly send or request money to $1,000 per week or $250 per transaction.

Payments can be sent to anyone else with a Cash App account and associated debit card or bank account. Users also get a unique cashtag handle to simplify the payment process. Payments happen instantly 24/7, with funds typically available in just seconds.

Cash Card

Users can order a free customizable Cash Card, which is a Visa debit card funded by the user’s Cash App balance. It allows users to easily spend their funds in stores, online, at ATMs, and anywhere Visa is accepted.

The Cash Card also offers “Cash Boosts” which are instant discounts and rewards when using the card at popular merchants like coffee shops, ride shares, groceries, and restaurants. These boosts encourage regular use of the card for payments.

Investing

Within Cash App, users can easily buy and sell stock in select major companies as well as Bitcoin with no fees. This provides an accessible investing experience for beginners to dip their toes in without commissions.

Users aren’t able to trade mutual funds, bonds, or other investments though - only stocks and Bitcoin. There’s also no margin trading or options offered. The investing platform does provide charts, interactive graphs, news, and educational guides.

Direct Deposit

Employers, gig workers, and freelancers can have their paychecks directly deposited into their Cash App balance rather than a traditional bank account. Deposits are usually available two days earlier as well.

Bitcoin

Cash App allows users to instantly buy, hold, or withdraw Bitcoin starting at as little as $1. There are no transaction or withdrawal fees, but there is a spread on purchases and sales.

The app doesn’t provide access to a private Bitcoin wallet and instead holds the coins until withdrawal. But Cash App does make it easy for users to get exposure to Bitcoin and transfer Bitcoin to others.

Referral Bonuses

Through its referral program, Cash App offers bonuses to existing users who convince their friends to sign up for new accounts. These bonuses often take the form of deposit bonuses, free stock rewards, and discounts.

AI Assistant

Cash App offers 24/7 customer support through an AI-powered virtual assistant. Users can ask questions and get help with common issues related to sending/receiving payments, the Cash Card, security, and more.

How Cash App Works

Cash App provides a straightforward user experience and process to send money, receive money, spend, and invest. Here’s a look under the hood at how it all works:

Link funding source - To start, users connect a bank account or debit card which will be used to fund the account and transfers. Money in a Cash App account is FDIC insured.

Receive cashtag - Each user receives a unique cashtag username (like jsmith12) to identify their account for sending/receiving funds. Usernames can be changed later if desired.

Add friends - Users can search for and add friends by their cashtag handle or phone number to send them money.

Initiate transfer - To send money, users enter the recipient’s cashtag, the transfer amount, and optional memo. Recipients get notified of the pending transfer.

Instant availability - Transfers between Cash App accounts are instant. For non-Cash App transfers, funds are usually available in 1-3 business days.

Spend with Cash Card - The prepaid Cash Card pulls from the user’s Cash App balance for purchases and ATM withdrawals. It works anywhere Visa debit is accepted.

Buy/sell Bitcoin - With just a few taps, users can purchase fractional shares of Bitcoin which are held in their Cash App account for easy transfer.

Invest in stocks - Users can browse trending stocks, search tickers, and trade shares immediately without fees or commissions.

Under the hood, Cash App leverages partnerships with banks, payment processors, and financial institutions to enable smooth, instant money transfers between accounts and the debit card.

Pros of Using Cash App

Cash App has grown quickly for good reason - it offers a number of compelling benefits:

Simplicity - Cash App provides an intuitive, user-friendly interface. Sending/receiving money takes just seconds with no hassle.

Speed - Transfers between Cash App accounts are instant. Non-Cash App transfers are usually 1-3 days but still faster than traditional bank transfers.

Convenience - The mobile-first design makes transferring money easy and accessible from anywhere at any time.

Cost - Peer-to-peer payments and Cash Card purchases are totally free. Other services like investing and Bitcoin carry no transaction fees.

Cash Card - The free customizable debit card empowers users to spend their funds from Cash App in stores and online.

Investing - Low fees and fractional share trading makes investing more accessible. Educational content helps first-timers.

Referral rewards - Cash App incentives promote referrals, growing its user base. Referrers can earn bonuses.

Privacy - Cash App uses bank-level security and encryption to protect personal data and transfers.

Cons of Using Cash App

However, there are some downsides to keep in mind as well:

Scams - Irreversible payments make Cash App vulnerable to scams. Users should only transact with trusted parties.

Support limitations - While AI-support is convenient, users may need to wait for an email response for more complex issues.

Limited investment options - Investing only allows buying stocks and Bitcoin. No mutual funds, bonds, options, or margin trading.

Bitcoin control - Users don’t have access to private Bitcoin wallets or full control. Coins are “held” in Cash App until withdrawal.

** Identification requirements** - Cash App requires government ID verification which raises privacy concerns for some users.

Bank transfers - Transferring funds between Cash App and a bank account takes 1-3 business days in most cases.

Lack of physical locations - As a mobile-only platform, Cash App lacks in-person support and physical branches.

While the convenience can’t be beat, users should weigh the pros and cons compared to traditional banking and payment methods. Cash App excels for quick transfers and intro investing but has limitations for advanced use cases.

How Cash App Makes Money

Cash App generates revenue through a variety of fees, service charges, and other methods:

Interchange fees - Cash App earns a small interchange fee from Visa on each Cash Card purchase and ATM transaction.

Investing - Cash App Investing likely generates revenue by earning interest on cash balances held by users investing on the platform.

Bitcoin exchange - Cash App profits from the spread or difference between the buying and selling price when users purchase Bitcoin.

Cash Boost - Merchants pay a fee to Cash App to offer exclusive discounts and bonuses to Cash Card users at their stores.

Withdrawal fees - While peer-to-peer payments are free, Cash App charges a 1.5% fee when transferring funds from an account to a bank account.

Business accounts - Cash App offers specialized business accounts that include additional features for a monthly fee.

Borrowing - Cash App generates interest income from its credit line offering called Borrow.

Referrals - Cash App likely earns money from referral bonuses that convince new users to join the platform.

The mobile-first, viral nature of Cash App along with its popularity with younger demographics offers significant monetization potential beyond just payment transfer fees. The company is still expanding its offerings to further diversify revenue streams.

###Cash App User Privacy and Security

With so much personal data and money at stake, privacy and security are major considerations for any financial platform or payment app. Here’s an overview of how Cash App approaches these concerns:

Encrypted data - Cash App uses encryption when data is in transit and at rest to prevent unauthorized access. Data is encrypted with AES-256, SSL, and TLS standards.

Fraud protection - Cash App monitors account activity to detect fraudulent behavior. Many transfers are instantly reversible as well in cases of error or fraud.

FDIC insurance - Cash App provides FDIC insurance protection up to $250,000 for funds held in Cash App accounts in the event Cash App fails.

PINs - Users can enable PIN authentication as an extra layer of security to access the app and approve transfers.

ID verification - Cash App requires government-issued ID verification to use many features as a way to prevent illegal activity.

Limits - Cash App enforces limits on transfer amounts and account balances to reduce large-scale abuse and fraud. AI monitors patterns.

Support - 24/7 support is available via chatbot for common security issues. Email support is available as well for more complex cases.

Data sales - Cash App states in its privacy policy that it does not sell or share personal data with third parties for marketing.

Overall, Cash App provides reasonable security precautions for a mobile payments app. However, users should still exercise caution when transacting.

Cash App Alternatives

Cash App dominates the peer-to-peer payments space, but it does face competition from a few other apps:

Venmo - Venmo pioneered mobile payments and is popular for social payments. Owned by PayPal, it offers similar features to Cash App like instant bank transfers, debit card payments, and purchasing cryptocurrency. However, Venmo lacks investing or Bitcoin withdrawal.

Zelle - Zelle is owned by major banks and seamlessly integrated into their mobile apps. Zelle’s advantage is quick no-fee transfers between bank accounts. But it lacks extensive features and product depth beyond P2P payments.

PayPal - In addition to Venmo, PayPal has its own mature digital wallet app and transfer capabilities. PayPal allows more extensive ecommerce, invoicing, company accounts, and other financial services compared to Cash App.

Apple Pay - Apple’s mobile wallet app offers peer-to-peer payments through its Apple Cash service. It provides a simple way for iOS users to send money, store cards, and pay online/in-stores using Apple devices only.

Google Pay - Google Pay enables Android users to send peer-to-peer payments with just a phone number. It offers the same capabilities as Apple Pay like contactless in-store payments and transit tickets for Android.

No other app quite matches the viral network effects, youth appeal, and brand recognition of Cash App. But for different use cases, specialized apps like Zelle for banking or PayPal for business may be preferable.

Free Download Cash App

You can download Cash App for Android either through the Google Play Store or by downloading the APK directly from our website.

Download from Google Play Store

The easiest way to download Cash App is through the Google Play Store.

Open the Play Store app on your Android device.

Search for “Cash App”.

Tap on the Cash App result published by Square, Inc.

Tap “Install” to download and install the app.

Once installed, open Cash App from your home screen to start using it.

Download the Latest APK

You can also download the latest APK file directly from our website:

Go to our website on your phone’s browser and scroll to the Cash App page.

Tap the “Download Latest APK” button. This will download the most up-to-date APK installer file for Cash App.

Once finished downloading, open your device’s File Manager and navigate to the Downloads folder.

Tap on the

cash-app-latest.apkfile.You may see a warning that the file can harm your device - tap OK to ignore this.

This will launch the Android installer. Tap “Install” to install Cash App.

Cash App is now installed and can be opened from your home screen!

Download Older Versions of Cash App

If you need an older version of Cash App, you can download previous APK versions from our site:

Go to the Cash App page and tap “Old Versions of App”.

This will display a list of previous Cash App version numbers. Tap the version you need.

Tap “Download” on the version’s page and the APK file will download.

Follow steps 3-7 from above to install the old APK file.

And that’s it! You now have Cash App installed on your Android device.

FAQs

Here are 10 frequently asked questions (FAQs) about Cash App:

1. What is Cash App?

Cash App is a mobile payment service developed by Square that allows users to transfer money to one another using a mobile phone app. Key features include peer-to-peer payments, a free customizable debit card (Cash Card), investing, and Bitcoin.

2. How does Cash App work?

To use Cash App, you link a bank account or debit card, receive a unique cashtag handle, add friends via their handle or phone number, and initiate instant transfers to them. Transfers between Cash App accounts are instant and typically free.

3. Is Cash App safe to use?

Cash App uses standard encryption and security measures to protect user data and money. As long as you only transact with people you trust, it is generally safe to use. Be cautious of scams though.

4. What can I use Cash App for?

Cash App allows you to instantly send/receive money, get paid via direct deposit, spend money using the Cash Card, invest in stocks and Bitcoin, and earn referral bonuses. It’s primarily used for personal transfers and purchases.

5. Is there a fee to use Cash App?

Peer-to-peer payments are free. There are no fees for buying/selling Bitcoin or stock investing. You can order a customized Cash Card for free. The only fee is 1.5% when instant transferring out to a bank account.

6. How do I get money out of Cash App?

To withdraw money from Cash App, you can instant transfer to a bank account for 1.5% fee or use the Cash Card for free purchases and ATM withdrawals. You can also request a paper check by mail for free.

7. Is Cash App FDIC insured?

Yes, Cash App provides FDIC insurance protection up to $250,000 per account in case balances are lost due to Cash App failure. This protects user money.

8. Can I cancel a payment on Cash App?

Unfortunately, once a payment is sent on Cash App it cannot be canceled. You must trust the recipient to refund your payment if needed. There are limits to prevent large erroneous transfers.

9. Does Cash App work internationally?

Cash App only works between users in the United States and Canada. You cannot send cross border or currency converted payments. The Cash Card only works at US merchants and ATMs.

10. What is the difference between Cash App and Venmo?

Cash App and Venmo offer similar peer-to-peer payment services. Main differences are that Cash App provides investing, Bitcoin transactions, and customizable debit card, while Venmo is more focused just on social payments.

Conclusion

Cash App has disrupted the world of mobile payments and financial services by providing an incredibly fast, convenient platform for P2P payments, investing, earning, and spending money. Its focus on simplicity and user-experience is evident in its rapid growth.

While Cash App comes with some risks around security and fraud, its reliability continues to improve. For most use cases, Cash App offers significant advantages over traditional banking with its immediacy, Cost, and accessibility.

Looking ahead, Cash App is well-positioned to expand into other financial services like lending, credit cards, savings, and more while retaining its loyal millennial user base. Competitors will struggle to catch up with the strong network effects fueled by Cash App’s virality as both a financial utility and social platform.

In an increasingly digital world, expect services like Cash App to continue gaining market share across all demographics as mobile peer-to-peer payments become the norm.