|

Name:

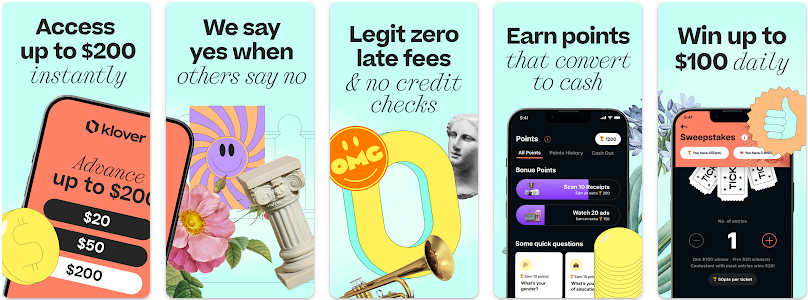

Klover - Instant Cash Advance

|

|

|

Version:

4.1.0

|

Price:

Free

|

Updates

Here are some of the new features included in the latest version of Klover - Instant Cash Advance App:

- Faster onboarding: The onboarding process has been streamlined, making it easier to get started with Klover.

- Improved eligibility: Klover has made it easier to qualify for a cash advance, so you’re more likely to be approved.

- New features: Klover has added a number of new features, including the ability to track your spending and set spending limits.

- Bug fixes and performance improvements: A number of bugs have been fixed, and the app has been optimized for better performance.

If you’re looking for a way to get a cash advance quickly and easily, then Klover - Instant Cash Advance App is a great option. The latest version of the app includes a number of new features that will make your experience even better.

Klover is a mobile app that offers instant cash advances of up to $200 to users who link their bank account. The app also provides budgeting tools and other financial services.

To use Klover, users must first link their bank account to the app. Once their account is linked, they can request a cash advance of up to $200. The cash advance will be deposited the users bank account within 24 hours.

Klover charges a fee of $5 for each cash advance. However, there are no late fees or interest charges. Users can repay the cash advance at any time, without penalty.

In addition to cash advances, Klover also offers a number of other financial services, including budgeting tools, bill pay, and savings goals. The app also offers a rewards program that gives users points for taking surveys, watching videos, and referring friends. These points can be redeemed for cash advances, gift cards, or other rewards.

Klover is available for download on the App Store and Google Play. The app is free to download and use.

Here are some of the pros and cons of using Klover:

Pros:- Instant cash advances

- No late fees or interest charges

- Budgeting tools

- Bill pay

- Savings goals

- Rewards program

- $5 fee for each cash advance

- Some users have reported problems with the app

- Klover is not available in all states

Overall, Klover is a convenient way to get access to cash when you need it. The app is easy to use and offers a number of features that can help you manage your finances. However, its important to keep in mind that Klover does charge a fee for each cash advance. If youre looking for a way to borrow money without paying interest, you may want to consider a personal loan or a credit card.

Here are some frequently asked questions about Klover:

-

How do I get started with Klover?

To get started with Klover, youll need to download the app and create an account. Once youve created an account, youll need to link your bank account to the app. After your bank account is linked, you can start requesting cash advances. -

How much can I borrow with Klover?

You can borrow up to $200 with Klover. -

How long does it take to get a cash advance from Klover?

Once youve requested a cash advance, it will be deposited your bank account within 24 hours. -

What are the fees for using Klover?

Klover charges a fee of $5 for each cash advance. -

Are there any late fees or interest charges with Klover?

No, there are no late fees or interest charges with Klover. -

What are the benefits of using Klover?

Klover offers a number of benefits, including instant cash advances, no late fees or interest charges, budgeting tools, bill pay, savings goals, and a rewards program. -

What are the drawbacks of using Klover?

The only drawback of using Klover is that it charges a fee for each cash advance. -

Is Klover available in all states?

No, Klover is not available in all states. You can check the Klover website to see if its available in your state.