|

Name:

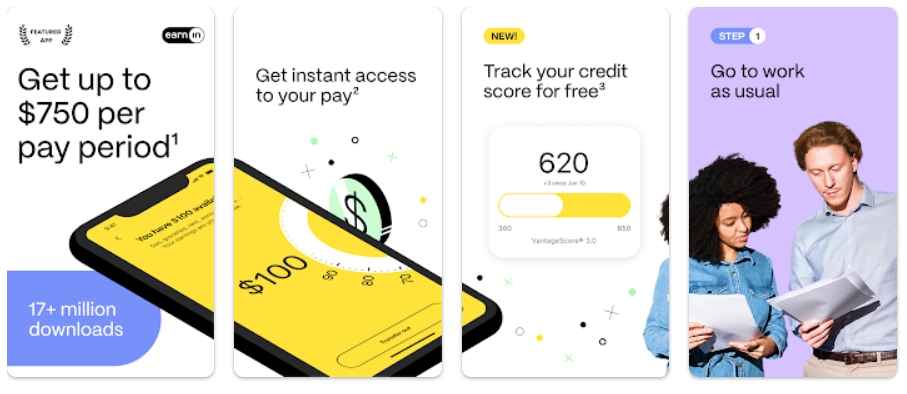

EarnIn: Make Every Day Payday

|

|

|

Version:

14.44

|

Price:

Free

|

EarnIn: Make Every Day Payday

An App That Lets You Access Your Earned Wages Early

Updates

- Version :

- Bug fixes and performance improvements

- New feature: Early Pay Max increased to $1,000

- New feature: EarnIn now offers “Tips” to help users save money

Brief Overview

EarnIn is a mobile app that allows you to access your earned wages early, without having to wait for payday. The app connects to your bank account and tracks your hours worked. Based on your earnings, EarnIn allows you to borrow up to $100 per day or $750 per pay period. The money is typically deposited your bank account within minutes.

Features

- Early Pay: Access your earned wages early, without having to wait for payday.

- Up to $100 per day or $750 per pay period: Borrow up to $100 per day or $750 per pay period.

- Fast payouts: Money is typically deposited your bank account within minutes.

- No credit checks or interest: EarnIn does not charge interest or require credit checks.

- Tips: EarnIn now offers “Tips” to help users save money.

Pros

- Can help you avoid overdraft fees: If you’re short on cash before payday, EarnIn can help you avoid overdraft fees.

- Can help you cover unexpected expenses: If you have an unexpected expense, EarnIn can help you cover it without having to wait for payday.

- No interest or credit checks: EarnIn does not charge interest or require credit checks, making it a more affordable option than payday loans.

Cons

- Fees: EarnIn charges a small fee for each early payout.

- Limits: You can only borrow up to $100 per day or $750 per pay period.

- Not available to everyone: EarnIn is not available to everyone. You must have a regular job and a direct deposit bank account.

Overall, EarnIn is a useful app that can help you manage your finances. However, it is important to be aware of the fees and limits before using the app.