|

Name:

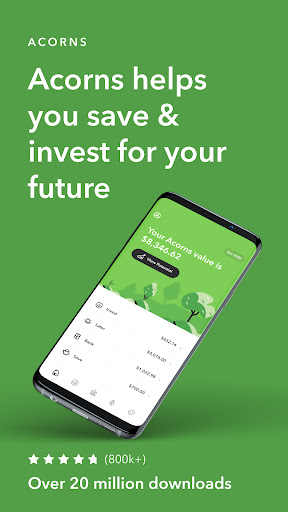

Acorns

|

|

|

Version:

7.7.2

|

Price:

Free

|

Acorns: Invest for Later

Updates

- Version :

- Bug fixes and performance improvements

- New feature: Round-Ups boosted for select merchants

- New feature: Acorns now offers fractional shares of ETFs

Brief Overview

Acorns is a micro-investing app that helps you invest your spare change. The app rounds up your purchases to the nearest dollar and invests the round-ups in a diversified portfolio of ETFs. You can also set up automatic contributions to your Acorns account.

Acorns makes investing easy and accessible to everyone. You don’t need any investment experience to get started. And you can start investing with as little as $5.

Features

- Round-Ups: Round up your purchases to the nearest dollar and invest the round-ups in a diversified portfolio of ETFs.

- Automatic contributions: Set up automatic contributions to your Acorns account.

- Choose your portfolio: Choose the Acorns portfolio that’s right for you based on your risk tolerance and investment goals.

- Track your progress: Track your investment progress and see how your money is growing over time.

- Learn about investing: Get access to educational resources to help you learn about investing.

Pros

- Easy to use: Acorns is very easy to use and doesn’t require any investment experience.

- Affordable: You can start investing with as little as $5.

- Diversified portfolio: Acorns invests in a diversified portfolio of ETFs, which helps to reduce your risk.

- Educational resources: Acorns offers a variety of educational resources to help you learn about investing.

Cons

- Fees: Acorns charges a monthly fee of $1 or $3, depending on the plan you choose.

- Limited investment options: Acorns only invests in a limited number of ETFs.

- No tax benefits: You won’t be able to deduct your contributions to Acorns from your taxes.

Overall, Acorns is a great app for beginners who want to start investing. It’s easy to use, affordable, and offers a diversified portfolio of ETFs. However, if you’re looking for more investment options or want to be able to deduct your contributions from your taxes, you may want to consider a different investment platform.